Hurricane impact windows do more than protect your home from flying debris; they also help reduce energy loss and improve indoor comfort. But can these windows actually qualify for energy tax credits or rebates? The short answer is yes, if they meet specific energy efficiency standards. In this guide, Guardian Shield Windows & Doors breaks down how federal energy incentives and Florida programs apply to hurricane impact windows, and how homeowners can benefit from both safety and savings.

Understanding Energy Efficiency in Impact Windows

Impact windows are not just about storm protection; they’re also energy performance systems.

By combining laminated impact glass, Low-E coatings, and insulated frames, they reduce heat transfer, block UV rays, and stabilise indoor temperatures.

The U.S. Department of Energy measures energy efficiency in windows using two key metrics:

- U-Factor: Measures how well a window insulates. The lower the number, the better the insulation.

- Solar Heat Gain Coefficient (SHGC): Measures how much solar heat passes through. Lower SHGC values mean less heat buildup indoors.

To qualify for federal energy tax credits, impact windows must meet or exceed Energy Star® performance criteria based on your region’s climate zone.

Federal Energy Tax Credits Under the Inflation Reduction Act

The Inflation Reduction Act of 2022 (IRA) extended and expanded energy efficiency incentives for homeowners through 2032.

Under this program, eligible windows and doors can qualify for a 30% federal tax credit, up to $600 for windows and $500 for doors per year.

Eligibility Requirements:

To claim this credit, your hurricane impact windows must:

- Be Energy Star certified for your climate zone (Southern U.S. region).

- Be installed in your primary residence (not rental or vacation homes).

- It should be installed by a qualified contractor following the manufacturer’s specifications.

- It will be purchased and installed between 2023 and 2032.

Example:

If you install $2,000 worth of Energy Star-rated impact windows, you can claim a $600 federal tax credit on your income taxes.

Florida State and Local Rebate Programs

In addition to federal incentives, many Florida counties and utilities offer rebates for energy-efficient home upgrades, including hurricane impact windows.

Examples of Local Programs:

- Florida PACE Program: Allows homeowners to finance impact windows through property taxes, often with 0% interest for qualified applicants.

- Florida Power & Light (FPL) Energy Rebates: Offers rebates for homes that improve energy efficiency through certified window upgrades.

- City-Specific Incentives: Some municipalities (like Tampa and Miami-Dade) have local grants promoting energy-efficient retrofits to strengthen hurricane resilience.

Tip: Always check your utility provider’s or county’s energy efficiency page for the latest rebate updates.

The Dual Benefit Protection + Savings

What makes impact windows unique is their ability to deliver both safety and efficiency.

Here’s how homeowners benefit:

- Lower Energy Bills: Up to $300–$500/year in cooling savings from reduced heat transfer.

- Insurance Discounts: Many insurers offer reduced premiums for homes with certified impact windows.

- Noise and UV Reduction: Energy-efficient laminated glass blocks up to 99% of UV radiation and outdoor noise.

- Increased Property Value: Buyers are willing to pay more for homes with both hurricane protection and energy savings.

Impact windows are one of the few home upgrades that pay you back over time, both through energy credits and monthly utility savings.

How to Claim Your Tax Credit or Rebate

Step 1: Choose Energy Star-certified hurricane impact windows.

Step 2: Keep all purchase and installation documentation.

Step 3: File IRS Form 5695 when completing your federal tax return.

Step 4: If applicable, apply separately for Florida utility or PACE rebates through your local energy office.

Pro Tip: Always consult a certified tax professional to ensure your installation qualifies and is properly documented.

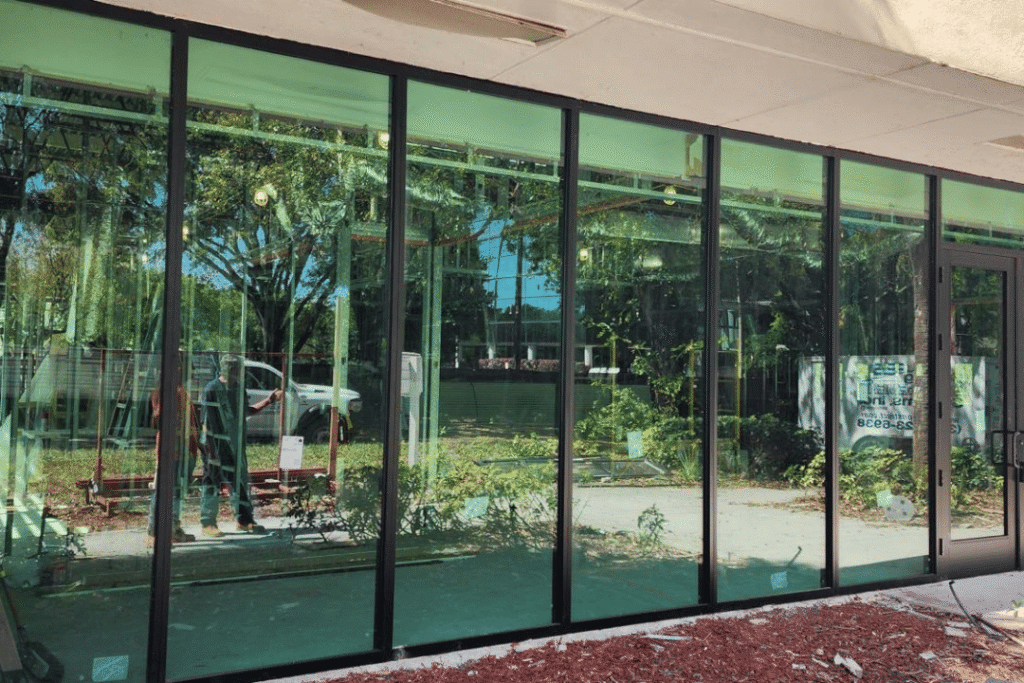

Guardian Shield’s Commitment to Energy-Efficient Protection

At Guardian Shield Windows & Doors, we install only Miami-Dade and Energy Star-certified impact window systems designed to perform on both fronts, storm protection and energy conservation.

Our products not only meet Florida’s hurricane standards but also align with federal energy efficiency requirements, helping homeowners stay safe and save money.

Whether you’re upgrading to qualify for credits or replacing ageing windows, our team ensures your investment delivers lasting performance, comfort, and compliance.

See How Much You Could Save With Energy-Efficient Impact Windows

Outdated windows can waste energy and leave your home unprotected during storms. Guardian Shield Windows & Doors installs high-performance, energy-smart impact windows that may qualify for federal tax credits and local rebates.Book your complimentary consultation today and get expert guidance on maximising both savings and storm protection.